Taxing Fossil Fuel Profits - CleanTechnica

Source: cleantechnica

Author: @cleantechnica

Published: 2/21/2026

To read the full content, please visit the original article.

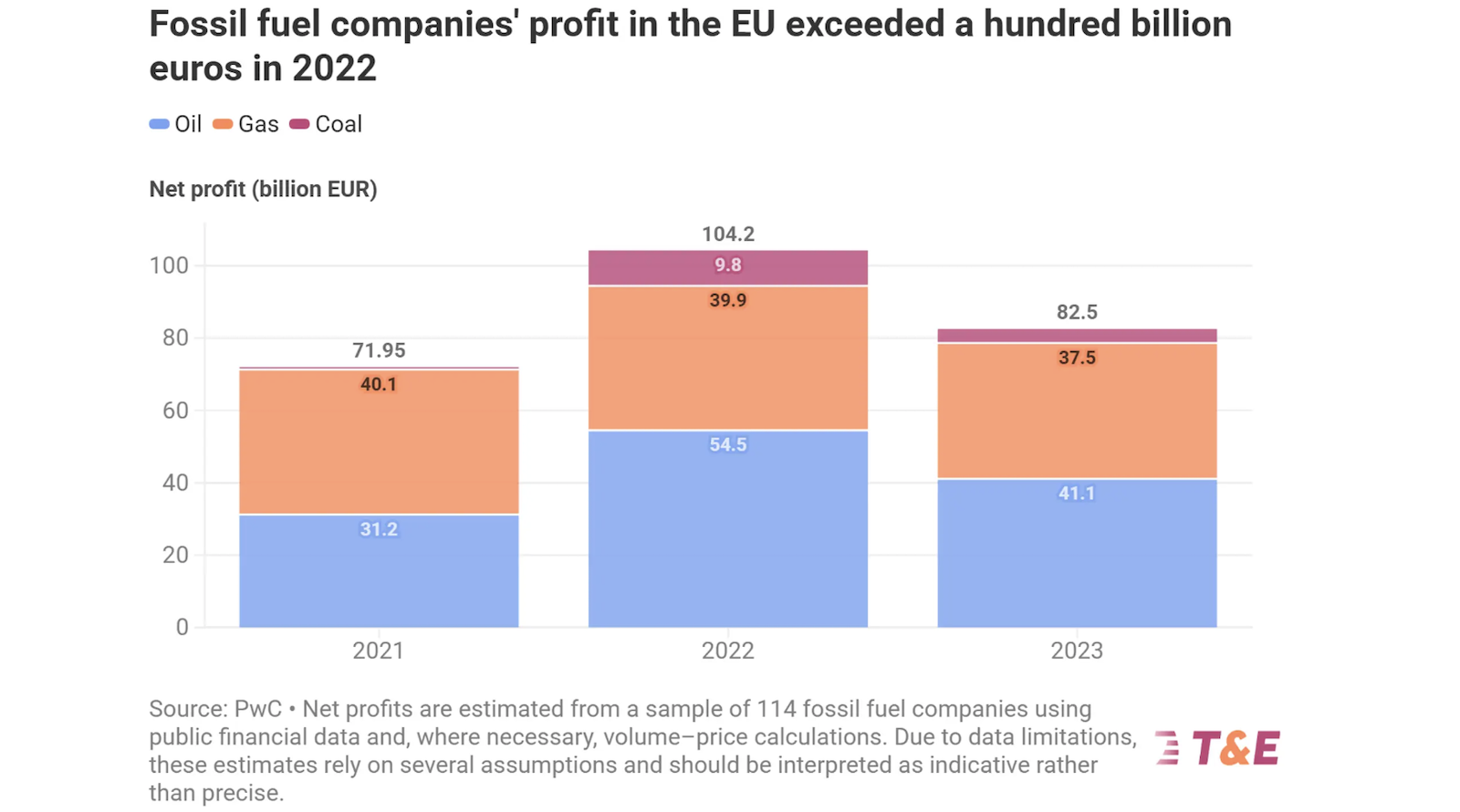

Read original articleThe article from CleanTechnica discusses the significant profits fossil fuel companies have made in the EU amid ongoing high energy prices and heavy dependence on fossil fuel imports, which accounted for about 70% of the EU’s energy consumption. In 2022, fossil fuel company profits exceeded €104 billion, a 45% increase from the previous year, and remained substantial at over €82 billion in 2023 despite a decline. The article highlights a new study commissioned by cE and CAN Europe, which argues that taxing these profits can be a fair and effective tool to finance Europe’s energy transition, protect consumers and workers, and reduce reliance on fossil fuels.

The study emphasizes that fossil fuel companies benefit from declining corporate income tax (CIT) rates and generous exemptions, allowing high profitability with relatively low tax burdens. Unlike carbon pricing mechanisms, company profits have largely escaped targeted environmental taxation, with the 2022 EU solidarity contribution on windfall profits being a rare exception. Taxing fossil fuel profits is considered

Tags

energyfossil-fuelsenergy-transitiontaxationEU-energy-policyclean-energycarbon-pricing